Contents:

The funds sanctioned and the tenure of these advances is governed by the agreements between RBI and the respective authorities. Therefore, it is very important for the authorities to strike a balance between AML and other measures intended to curb illegal activity and maintain the confidentiality of personal and financial information of citizens. The introduction of CBDC will increase the security and safety of transactions as all of them will be validated and captured in a distributed ledger.

Central Banking Awards 2023 – the winners in full – Central Banking

Central Banking Awards 2023 – the winners in full.

Posted: Mon, 27 Mar 2023 11:45:11 GMT [source]

The journal also includes segregated data sources on some essential factors relating to bank-wise, bank group-wise and state-wise level of information. Often regarded as the banker of banks, the RBI acts as a parent to all commercial banks in India. Thus, it becomes the lender of the last resort for all banks when they are in a crisis situation. RBI helps them by lending money, although at higher RoI, to sail through the tide of financial difficulties. The RBI has a separate publication section that collects and publishes data on many sectors of the economy. As the premier financial institution, the RBI must gather, process, and distribute statistics data on a wide range of issues.

Nvli Repository

Moreover, programmable payments can also be used in industrial supply chain ecosystems. In this case, pre-programmed digital CBDC could only be used for specific purposes such as fuel expenses and state border taxes. Apart from these, CBDC also helps in implementing anti-money laundering and combating financial terrorism measures by acting as a highly secure way for cross-border transactions.

Intellect is the proud recipient of the Payments Provider of the Year Award-2016 and Technology Provider of the Year Award-2015 from the Central Banking Forum. Intellect also won the prestigious Asian Banker award for the ‘Best Central Bank Technology Project-2013’ for this large scale modernization initiative at Reserve Bank of India. The Core Banking System for a central bank is significantly different from the Core Banking System in a commercial Bank.

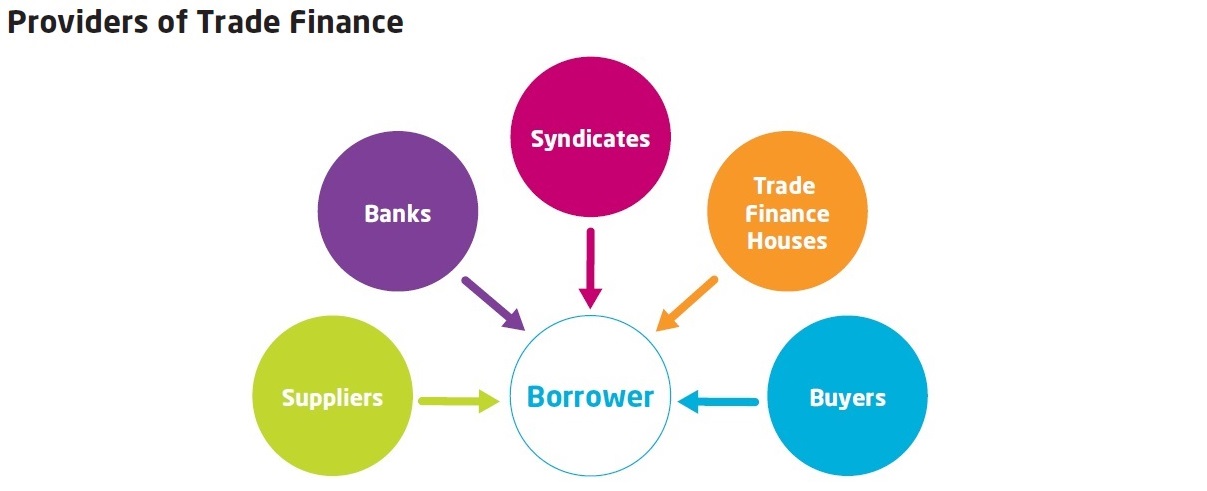

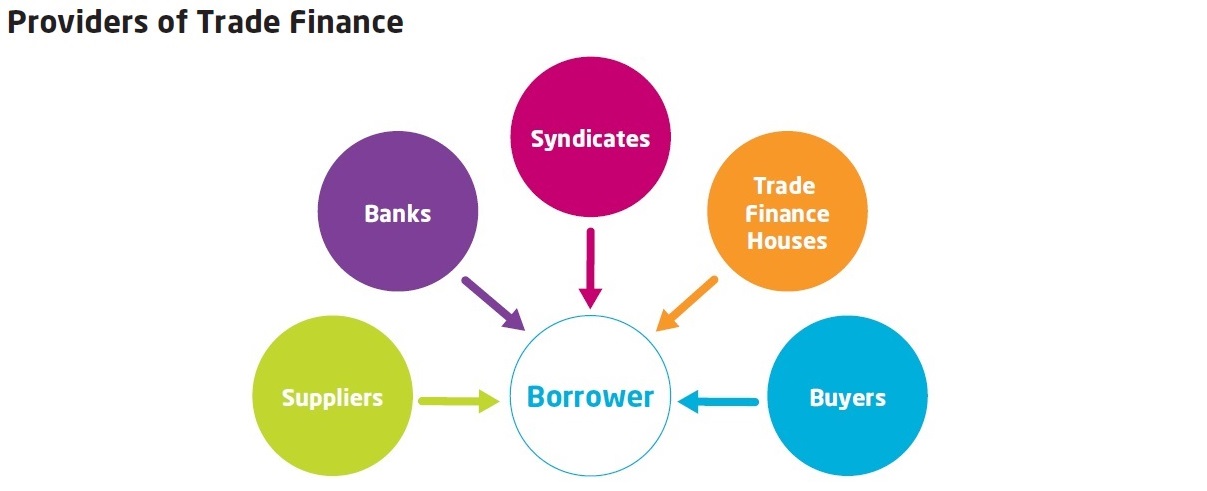

Alternatively, retail CBDC can be issued to intermediaries (which can be public/ private banks) who then issue it to the public much like a fiat currency. This method of distribution forwards the counterparty risk towards the regulated intermediaries and is called indirect issuance. A third issuance methodology, called hybrid issuance, can also be followed, in which retail CBDC is issued to intermediaries, as in the case of indirect issuance. However, in the case of hybrid issuance, the central bank periodically updates its own ledger with the retail balance records. This category of CBDC acts as the digital format of the fiat currency which is meant for the general public and used by ordinary consumers to conduct financial transactions for day-to-day activities.

The flow of events and ideas behind central banking in india banking in India, in four distinct phases since independence—1950–70, 1970–90, 1990–2010, and post 2010—is narrated. The 1950–70 period is characterised as one of planned fiscal dominance, while the 1970–90 period has seen the dominance of the fiscal and financial sector with an inward-looking bias. The period since 2010 is broadly categorised by the rebalancing and adoption of a new framework, like inflation targeting.

Categories of CBDCs

The RBI has always attempted to offer critical training to banking industry personnel. It has created bankers’ training institutes around the country, including the National Institute of Bank Management, Bankers Staff College, College of Agriculture Banking, and others. These tasks are essentially in line with the goals for which the RBI was established.

- CBDC’s underlying technology, along with the currency’s digital nature, make it superior to existing digital payments.

- To build a CBDC ecosystem and make it sustainable, it is essential to address all these issues and for CBDC to act as a tool for inclusion by solving the problems through innovation, as in the case of offline payments.

- It would be safe to say that these areas need further deliberation by the central bank and the government.

This lending is done on the basis of government securities, treasury bills, government bonds, etc. The meaning of central bank is a financial institution that has the privilege of producing and distributing money for a country or a group of countries. The central bank, in the modern economy, is also responsible for regulating member banks and formulating monetary policies. This article will acquaint you with the importance of the central bank with a focus on the functions of the central bank of India. Every commercial bank is required by the RBI to maintain CRR, which stands for Cash Reserve Ratio.

RBI policy highlights: Prioritising inflation over growth, says Das

To keep the rupee’s external value stable, domestic policies must be prepared in this direction. It must also develop and implement a foreign exchange rate policy that contributes to exchange rate stability. To accomplish this, the RBI must bring foreign currency demand and supply closer together.

Customers’ confidence in Central Bank of India’s wide ranging services can very well be judged from the list of major corporate clients such as ICICI, IDBI, UTI, LIC, HDFC as also almost all major corporate houses in the country. Currently, market risk is assessed as per the Stressed-Value at Risk methodology . The Committee recommended adopting the Expected Shortfall methodology under stressed conditions (with a confidence level ranging between 97.5% to 99%) to assess market risk. ES at 99% confidence level denotes the expected loss that can be ascertained with 99% confidence. The Reserve Bank also provides funds to the Central and State governments to manage temporary shortfall of funds.

Central Bank Digital Currency (CBDC) pilot launched by RBI in retail segment has components based on blockchain technology

The role of banks needs to be clearly defined in the whole distribution and management of CBDC with proper measures against disintermediation. The main difference between the two is that a central bank is responsible for overall monetary and financial stability, whereas commercial banks focus on providing financial services to customers and making a profit. Additionally, a central bank has the authority to regulate and supervise the activities of commercial banks, and has the power to create money and control interest rates. A commercial bank, on the other hand, is a private financial institution that provides various banking services to individuals and businesses, such as accepting deposits, making loans, and providing account services. Examples of commercial banks in India include State Bank of India, ICICI Bank, and HDFC Bank.

It undertakes periodic publication of reports regarding the functioning of various banks. It also publishes reports on currency and finance, trends and progress of banking and financial sectors in India and the progress of the Economy. It is also entrusted with computing and statistically analyzing India’s balance of payments data. Two-tier issuance architecture is a good approach for a retail CBDC as it helps in saving a run on the central bank. In this architecture, the central bank backs the issuance of CBDC and distribution to the general public by the commercial banks based on securities or cash deposits held at the central bank.

Like https://1investing.in/, the CBDC will not earn any interest and can be converted to other forms of money, like deposits with banks. On the inflation front, core inflation continues to remain a cause of concern not just for the RBI but for the global central bankers. In their recent monetary policy meeting, the Fed and the ECB have conveyed their uneasiness with the sticky and elevated core inflation. It has a legal monopoly status that enables it to issue cash and banknotes as opposed to private commercial banks that can issue only demand liabilities, for example, checking deposits. Prior to the 1991 financial reforms, the RBI’s primary instruments for controlling the money supply and interest rates in the market were the CRR and SLR.

Electronic Funds Transfer – This retail funds transfer system was to enable an account holder of a bank to electronically transfer funds to another account holder with any other intermediate or participating bank. Reverse Repo rate is the short-term borrowing rate at which RBI borrows money from other banks. The Reserve Bank of India uses this method to reduce inflation when there is excess money in the banking system. Report on Currency and Finance – This report is documented and presented by the staff of Reserve Bank of India bank and focusses on a particular theme and presents a detailed economic analysis of the issues related to the theme.

- It should also coexist with all the commercial bank accounts and work in harmony with fiat currency.

- They are profit-oriented organizations, aiming to make a return for their shareholders.

- It could bring to the fore major issues facing European banks that are battling lacklustre home markets and failed bets in mainland China, along with stiff competition from US banking behemoths.

- The Intellect QCBS at RBI is fully equipped to meet its current as well as future requirements be it from a policy or a security standpoint.

These services include accepting deposits, making loans, and facilitating the transfer of funds. Commercial banks also offer a wide range of other financial services such as issuing credit and debit cards, providing online and mobile banking, and offering investment products. They accept deposits from customers and use these funds to make loans to businesses and individuals. They also earn a profit by charging interest on loans and paying lower interest on deposits.

National Electronic Clearing Service – This facilitates multiple advantages to beneficiary accounts with destination branches against a single debit of the account of the sponsor bank. A separate clearing system for paper-based payment method was introduced for clearing cheques of high-value ranging from rupees one lakh and above. Also, the introduction of cheque truncation system restricts the physical movement of cheques and utilises images for enhanced secure payment processing. Magnetic Ink Character Recognition technology was introduced by RBI in the paper-based payment method for speeding up and bringing in efficiency in the processing of cheques.

Then came the Silicon Valley Bank collapse, and central banks were suddenly not smelling so good. Structurally, the rational expectations sentiment of the markets, which factors in perfect information between the central bank and economic agents, is seen to be counterproductive and ineffective. The recent Fed chair Jerome Powell’s interview also talked about it and so has the RBI as it believes that leaving room for adaptive expectations, that accommodate progressive adjustments to uncertainties, may improve the efficacy of monetary policy actions.